Debunking the Top Five Myths About Outsourced Trading

The Myths, Their Origin & Persistence

Over the past decade, outsourced trading (OT) has evolved from a niche offering to a transformative solution for hedge funds and investment managers. Outsourced trading helps firms gain access to specialized trading talent, navigate illiquid markets and new geographies, and convert fixed costs into scalable variable expenses. For investment managers looking to scale, OT provides a compelling alternative to traditional in-house trading desks. Yet, despite its clear benefits and growing adoption, misconceptions about OT persist. While these misunderstandings were rooted in limitations of traditional outsourced trading providers, some newer OT models offer tailored, sophisticated, and conflict-free value-added services that challenge prior assumptions. Addressing these myths is essential to unlocking the full potential of modern OT and enabling investment firms to embrace efficiency without sacrificing control.

In this article, we’ll tackle five of the most common myths about outsourced trading, drawing on our experience working with a diverse range of investment firms and hedge fund managers. It is important to note that not all OT models are created equal. At Meraki, we’ve pioneered a unique approach to OT called Integrated Trade Management (ITM). This outsourced trading solution is different from classical OT approaches: a conflict-free, transparent, and client-centric model that helps firms optimize their trading process through a partner that’s aligned with their interests. ITM provides clients sophisticated traders who think conceptually and provide valuable feedback. While some myths are true of the classical OT models, they no longer hold with ITM.

Let’s get on with our myth busting.

Listen to “Debunking the Top Five Myths About Outsourced Trading” >>

Myth 1: Outsourced Trading is Only for Small or Emerging Managers

One of the most common misconceptions about outsourced trading is that it works only for small or emerging managers who lack the resources to build in-house trading desks. While this may have been true in the early days of OT, the model has matured to meet the needs of larger, well-established investment managers. It is no longer just suitable for small funds. Firms managing $500M to over $20B in assets now rely on OT to expand their global market reach efficiently and effectively while accessing specialized expertise with different asset classes that they may lack internally. OT has become a strategic tool for mid-sized managers looking to improve competency trading certain markets without giving up control of their book. It also helps larger managers scale and add geographical exposures without adding overhead.

Case in point: Our recent work with a hedge fund client managing over $2B highlighted how OT filled critical gaps in their trading operations. The asset manager had a single internal trading desk based in the US but faced challenges trading Asian markets. The firm was passing orders off to a small number of brokers for overnight execution with pre-set parameters. Consequently, they limited their ability to react to market moves and missed liquidity and large block opportunities particularly in small and mid-caps. Rather than hire multiple traders with regional expertise and incur the associated costs—salaries, technology, and time to onboard & train the new personnel—Meraki took responsibility for APAC trading. By tapping into our Integrated Trade Management model, the firm was able to immediately deploy local APAC capability, gaining 24/6 coverage, regional trading expertise, and the ability to seamlessly trade in Asia without adding internal headcount. Importantly, this allowed the portfolio managers to focus on their core strategy and alpha generation without the disruption of market volatility. The firm now has a robust trading solution in an off-hours region which has allowed them to source better liquidity and prices, ultimately resulting in lower implementation costs and improved performance overall.

Myth 2: Outsourced Trading Means Losing Control

Some managers worry that outsourcing trading means losing control over the order process and critical decision-making. Their major fear: physical separation from the traders means loosening the grip on their portfolio. They don’t want their traders to be more than a literal arm’s length from them at times, or worse, unreachable. While this concern may be valid with some OT providers that have a high client to trader ratio, it is not true with all OT providers and certainly not true with Integrated Trade Management where the client to trader ratio is kept low for that specific purpose. We have recently written a whitepaper dedicated to the topic of control and detailed how managers can retain control with OT if they work with the right partner.

The key to control is integration into the workflow of your investment team, not necessarily the physical location of the traders. Some OT partners, like Meraki, offer tailored solutions and integrate directly with a fund’s existing investment team and infrastructure, acting as an extension of its internal team. With the ITM model, the outsourced traders are in regular contact with the investment team. They have time to dedicate to the client, while understanding their investment philosophy and strategy. Not only are they reachable around the clock, but they are fully immersed in the team; oftentimes communicating their own insights and experiences to the PM, allowing the PM to express his or her views more effectively. As always, the PM remains fully in control of the way his or her view is expressed and ultimately implemented.

This strong portfolio manager – trader connection in the ITM model affords the benefits of traditional OT engagements while still retaining full control for the client.

Myth 3: Outsourced Trading Is Only for Back-up or Basic Trading Needs

Outsourced trading is sometimes seen as a basic trading solution limited to straightforward equity trades. This couldn’t be further from the truth, especially with the new models of OT.

Modern OT firms like Meraki provide tailored solutions that excel in handling complex trading strategies, including exotic derivatives, futures and options, FX, distressed credit, rates, and trades in emerging markets debt and other illiquid instruments. For instance, Meraki has helped clients successfully navigate challenging situations like exiting large, illiquid positions in global emerging markets.

A recent trend has seen more sophisticated funds turn to OT for their ability to handle complex trades and multi-asset trades. Herein lies where choosing the right partner matters. Some OT providers focus mainly on equities and lack expertise in illiquid and exotic instruments. In contrast, Meraki’s approach follows the client’s investment strategy and supports a wide range of asset classes, from distressed debt to exotic FX and interest rate derivatives.

For example, in a recent transaction, we helped our client exit large, illiquid positions in markets like Indonesia and Bangladesh, where trades of this magnitude require finesse and nuanced experience in order to maneuver without market disruption and leakage. Having this flexibility enables established funds to enter markets they might otherwise avoid simply due to lack of specific competencies internally. Far from being limited to US equities, OT is increasingly recognized as an essential resource for funds of all strategies aiming to enact their global investable universe.

Myth 4: OT Providers are Opaque and Have Conflicts of Interest

This myth is only partially true because OT providers are often lumped together with introducing broker-dealers, raising very legitimate concerns about potential conflicts of interest. Again, not all OT models are created equal, and the right OT model and the right partner makes all the difference.

Traditional OT models may introduce conflicts of interests due to existing relationships with their executing broker parties and the risk that they prioritize those relationships over the client. The key to avoiding conflicts is alignment. Our model of engagement, ITM, is strictly focused on the client, placing them and their investment outcomes as the sole priority. The ITM model avoids this conflict by working only with each specific clients’ preferred counterparties and acts as an extension of the team rather than an intermediary with pre-existing relationships.

A real-world example from our experience highlights how ITM can work for a client. A client transitioning from a traditional OT provider expressed frustration that their trades were being routed predominantly through a single counterparty due to an existing relationship of the former partner. Under Meraki’s model, they were able to preserve direct relationships with their brokers as well as ensuring best execution practices were being upheld. Moreover, Meraki’s team worked within the client’s existing infrastructure, retaining the client’s operational autonomy and control.

Myth 5: Outsourced Trading Is More Expensive than In-House Trading

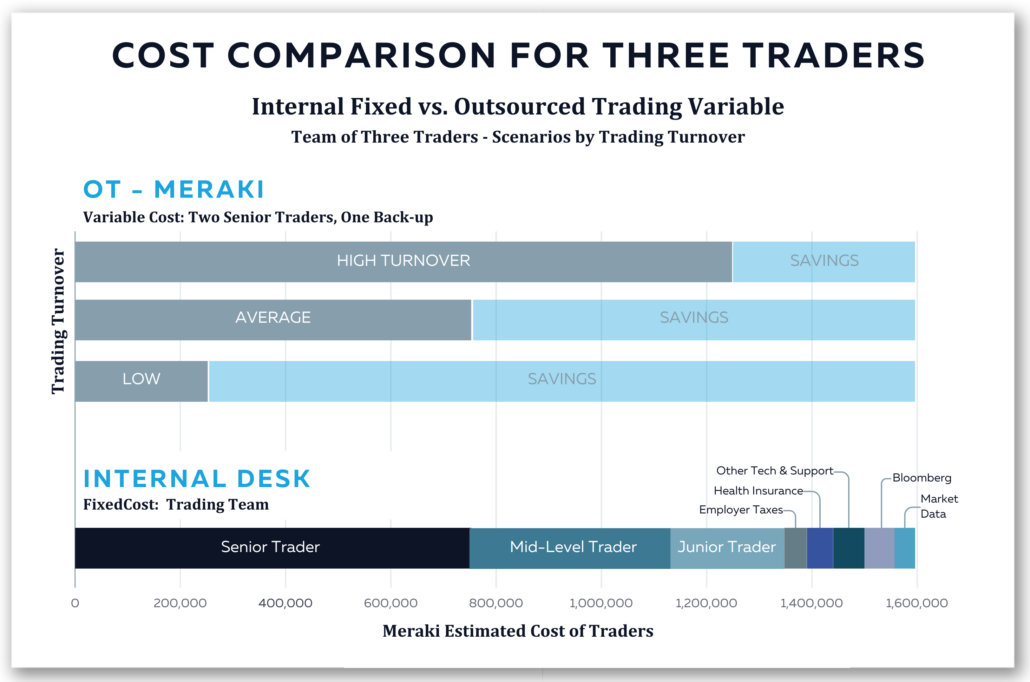

Maintaining an in-house trading desk is far more expensive than some managers initially understand. A single mid-level trader can cost an investment firm upwards of $300,000 annually in total compensation, before benefits and taxes. Additionally, the costs of essential trading infrastructure such as Bloomberg terminals, live market data, order and execution management systems (OMS/EMS), TCA tools, and compliance support, as well as health benefits, and the total expense quickly becomes a substantial burden on the management company.

For firms that trade across regions or asset classes, the need for multiple traders with specific market expertise and additional technology significantly compounds the costs. Firms trading Europe and Asia will need to hire multiple in-house traders to achieve the same level of coverage and expertise in those geographies, as well as meet industry best practice standards.

Not only can OT be more cost efficient in those circumstances but importantly, outsourced trading transforms fixed costs—like trader salaries & Bloomberg terminals– into variable costs tied directly to trading volume. This shift allows funds to allocate more resources to strategic areas like portfolio management and the investment team that will typically be more alpha generative, without being burdened by the overhead of an internal trading desk.

Below is a hypothetical comparison of the costs associated with an internal trading desk versus an OT services model like Meraki.

A few things to note here. Meraki primarily employs traders with extensive experience, boasting an average of over 15 years in the industry. Meanwhile, the typical internal trading desk can have a range of seniority. Here is the main difference in cost structure: as you can see from the chart, the costs with a traditional trading desk are fixed. You will need to pay salaries, benefits, bonuses regardless of how often you trade in a given year. In contrast, with OT, your costs are variable – depending on the volume and quantity of shares traded (velocity). They can be lower or higher on any given year, depending on how much the portfolio turns over. The benefit of this structure is that you only pay for the trading you need, and we feel that overall, it adds up to significant savings for the average fund manager.

Wrapping Up

Misconceptions about outsourced trading should not prevent managers from exploring a solution that offers flexibility, cost savings, and scalable trading expertise. By debunking these five myths, we hope we have delineated the differences in classical OT models vs. Integrated Trade Management and at least piqued your curiosity on what ITM can do for you and your firm.

If you’re curious about how OT can address your fund’s specific needs, contact Meraki Global Advisors today for a consultation. Together, we’ll tailor a solution that aligns with your goals and elevates your trading strategy.

Recent Whitepaper

Download our latest whitepaper, “In the Driver’s Seat: How Hedge Funds Can Leverage Outsourced Trading Without Losing Control.” Take the first step toward achieving more with your trading operation without giving up the control you value most.

About Meraki Global Advisors

Meraki Global Advisors is a leading outsourced trading firm that eliminates investment managers’ implicit and explicit deadweight loss resulting from inefficient trading desk architectures. With locations in Park City, UT and Hong Kong, Meraki’s best-in-class traders provide conflict-free 24×6 global trading in every asset class, region, and country to hedge funds and asset managers of all sizes. Meraki Global Advisors LLC is a FINRA member and SEC Registered and Meraki Global Advisors (HK) Ltd is licensed and regulated by the Securities & Futures Commission of Hong Kong.

For more information, visit the Meraki Global Advisors website and LinkedIn page

Contact:

Mary McAvey

VP of Business Development

(646) 666-7041

mm@mga-us.com

Meraki Global Advisors LLC is a FINRA registered broker-dealer and member of SIPC headquartered in Park City, UT. The content provided herein is not an offer, solicitation or recommendation of any securities. Meraki and its representatives make no investment recommendations whatsoever. Past performance is not an indication of future results. This document may not be duplicated or copied, is protected by copyright law and may contain privileged or confidential information. Information contained herein does not constitute tax, legal or other professional advice. Content is for informational and educational purposes only. All rights reserved 2025.