Shipments/ Fed Independence/ Favorite Post/ Most Popular

Shipments

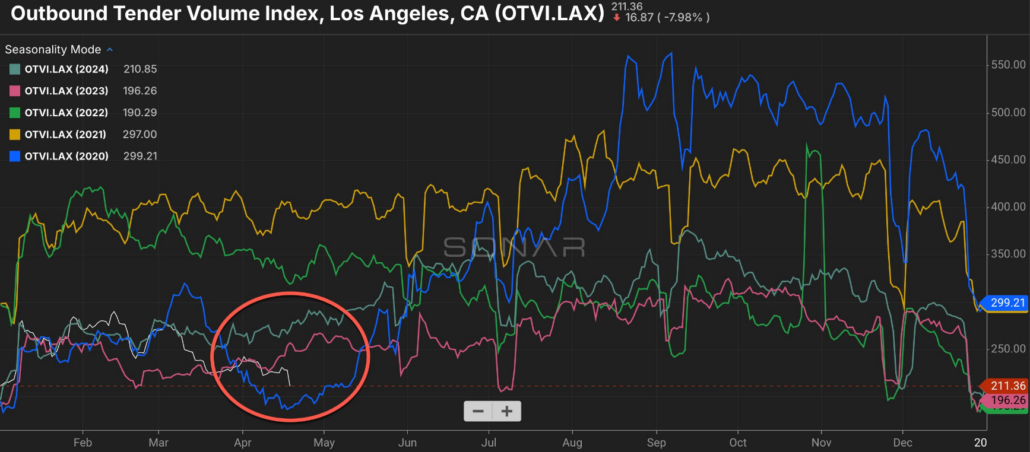

With all this tariff talk there has started to be quite a focus on shipments to the US, or lack thereof. Hard not see a chart of container, truck, or port utilization of late.

We would like to try and put some of the pieces together the way we see them.

So far 2025 is off to a bleak start, bested only by 2020 recently. Below is domestic freight out of the LA port. Less stuff leaving the port after being dropped off.

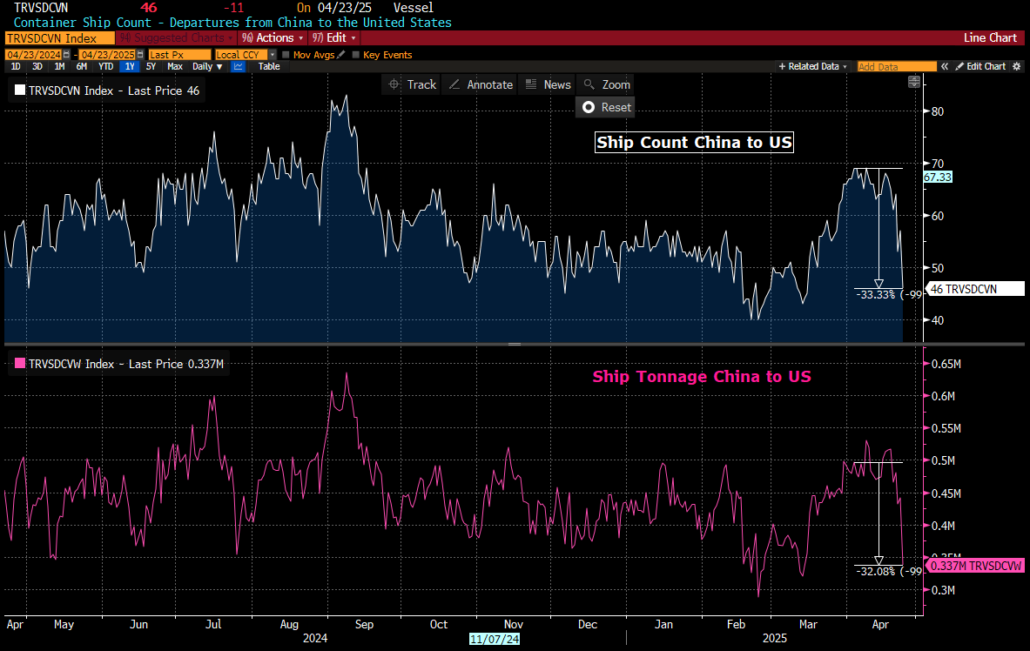

The below chart might help explain why.

Departures from China to the US in both ship count, white line, and tonnage, magenta line.

Both down roughly 32%!

Now, it takes 30 days for containers to go from China to LA.

So, the impact of the 32% drop off has yet to be fully felt.

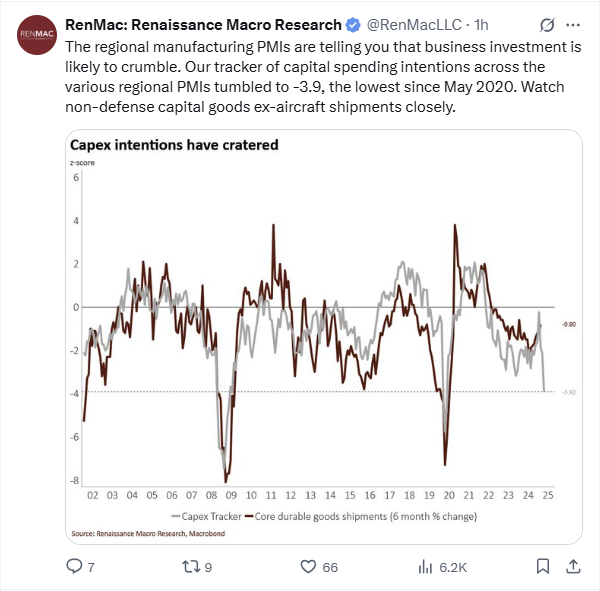

And that led us to wonder about business confidence and whether the lack of it will lead to less CapEx as well.

Which takes us to this chart:

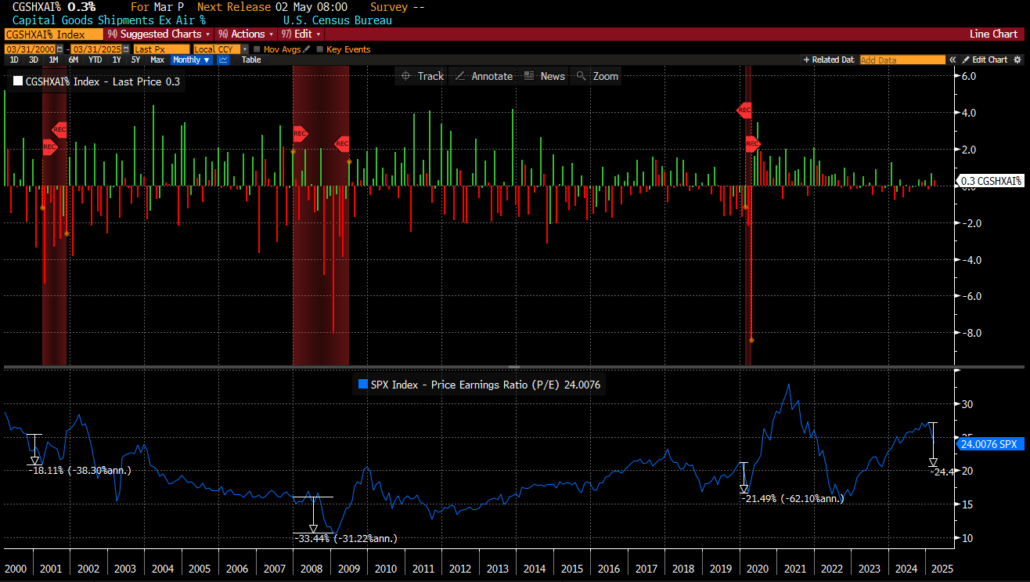

We took the above to heart and wanted to see how the Cap Goods shipments Nondef Ex Air looked presently. Maybe it’s coincidental or maybe causational, but when that metric moves substantially lower, GDP definitely slows down, and with-it trailing P/E multiples.

It has not rolled over just yet, but when it does it could definitely be an issue.

Which might be exactly why some are not waiting around to see the actual event.

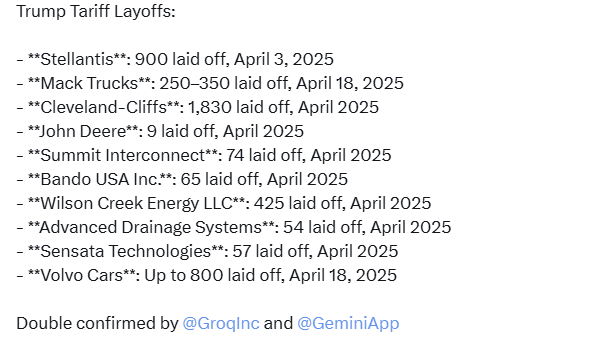

We hope this does not lead to more announcements like this.

Mack Trucks fires 350 workers in Pennsylvania—CEO says “President Trump’s tariffs are the driving force.” Workers will receive no severance or benefits—company exploits loophole over so called “probationary period.” Local economy will lose $260.59 Million per year—2.9% of the region’s manufacturing GDP. Mack Trucks announced the laying off of 350 workers—10% of all employees—at its Lehigh Valley Operations facility in Lower Macungie Township, Pennsylvania. This could trigger 220 indirect job losses in the local supply chain due to a 20% reduction in supplier contracts—exacerbating the economic impact on the Lehigh Valley region.

They are not alone:

Maybe the Equity market is starting to sense this. At the time of this writing the SPX is looking to have one of its better weeks, but high realized vol is not exactly the type of foundation on which to build a confident bull market.

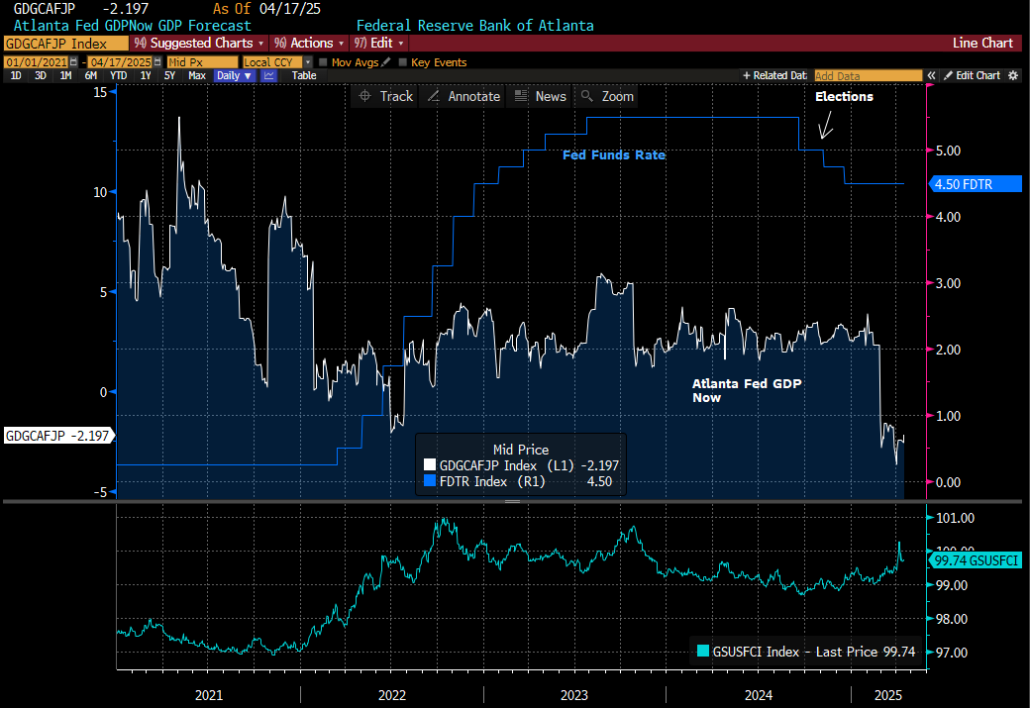

Fed Independence

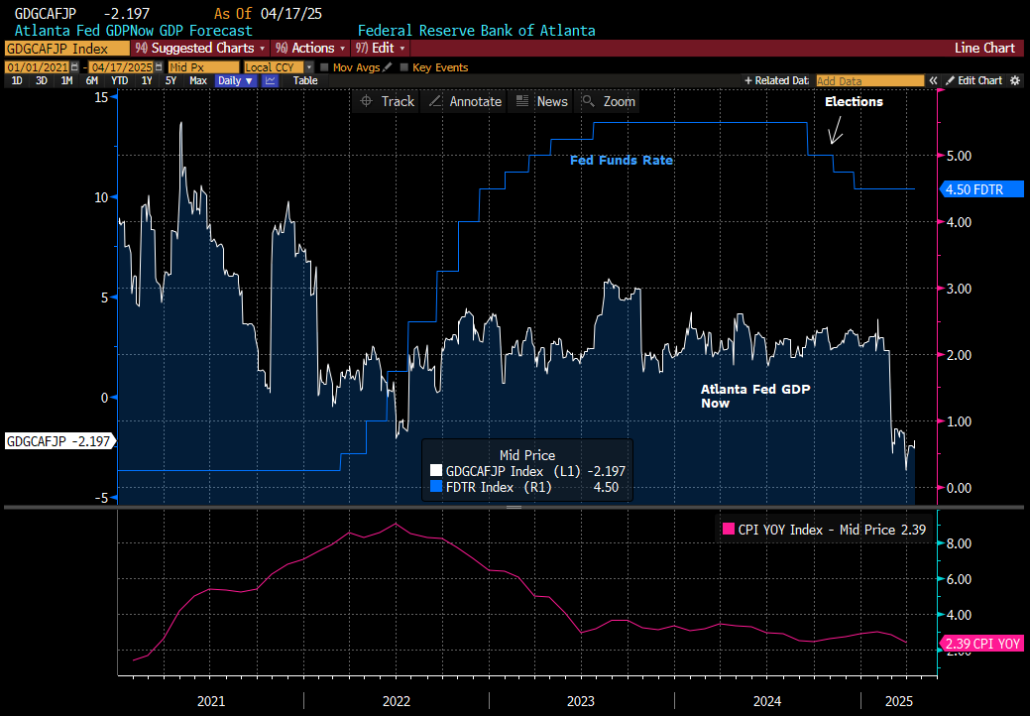

A lot of talk about the “Independence” of the Federal Reserve recently. But if one looks at a picture of GDP and Fed funds rate a little different picture emerges…

The ”Independent” Fed cut rates 100bps while the Atlanta Fed GDP Now was in the 3.5% range, presently it is 500bps+ below that and we they are in we are data dependent stage?

For good measure adding CPI which is roughly at the same level or lower than when the 100bps of cuts began. 10/31/24 reading was 2.6%, while most recent is 2.4%.

Meanwhile the GS Financial Conditions Index showing that conditions are tighter as well.

Favorite post

Self-explanatory

Most Popular

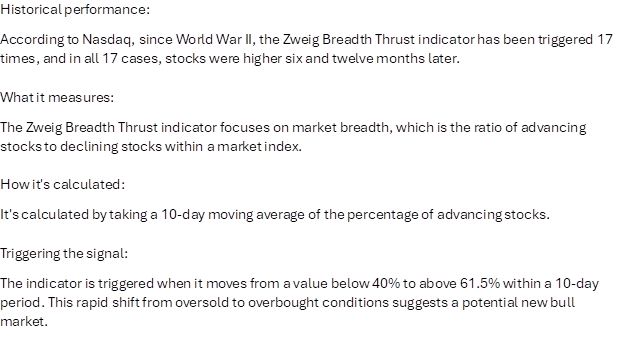

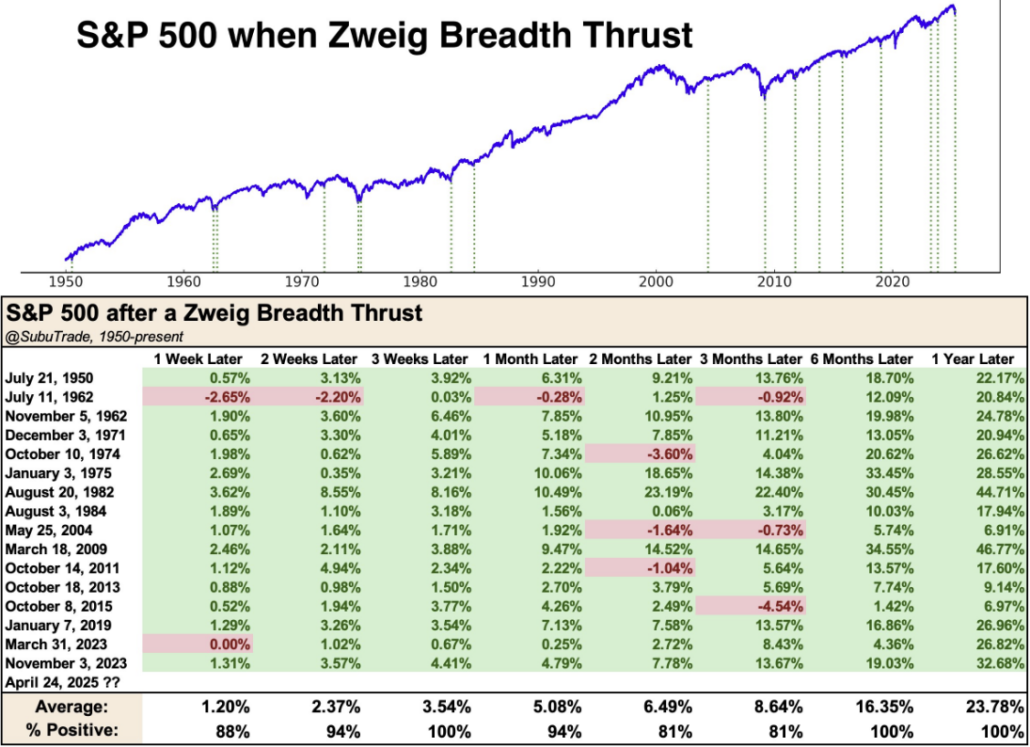

Most popular chart of the week?

What is the Zweig Breadth thrust?

Perspective

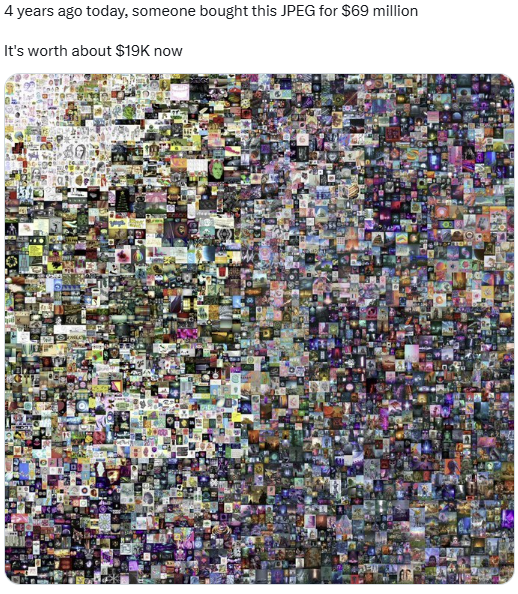

A gentle reminder of how crazy things can get:

Have a great weekend!

Best,

Meraki Trading Team

About Meraki Global Advisors

Meraki Global Advisors is a leading outsourced trading firm that eliminates investment managers’ implicit and explicit deadweight loss resulting from inefficient trading desk architectures. With locations in Park City, UT and Hong Kong, Meraki’s best-in-class traders provide conflict-free 24×6 global trading in every asset class, region, and country to hedge funds and asset managers of all sizes. Meraki Global Advisors LLC is a FINRA member and SEC Registered and Meraki Global Advisors (HK) Ltd is licensed and regulated by the Securities & Futures Commission of Hong Kong.

For more information, visit the Meraki Global Advisors website and LinkedIn page

Contact:

Mary McAvey

VP of Business Development