Employment & Rates/ Tariffs

Employment & Rates

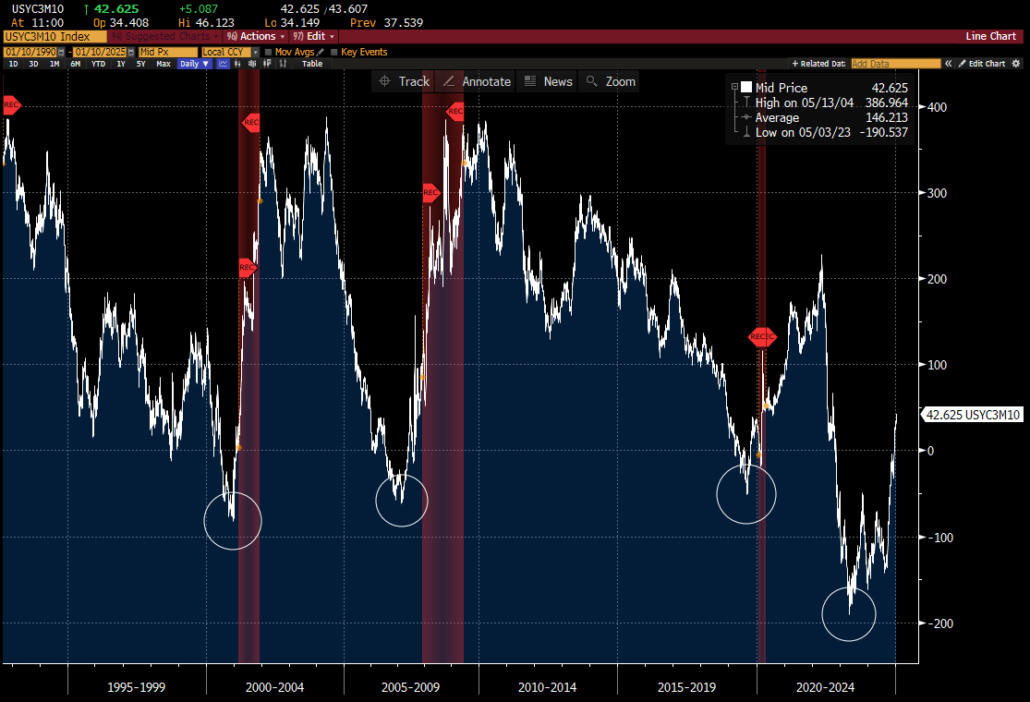

Still undefeated in signaling a US Recession?

It’s an interesting thought considering some of the Economic data reported this week. NFP came in strongly above expectations today, as well as JOLTS earlier in the week showing better Job openings than expected.

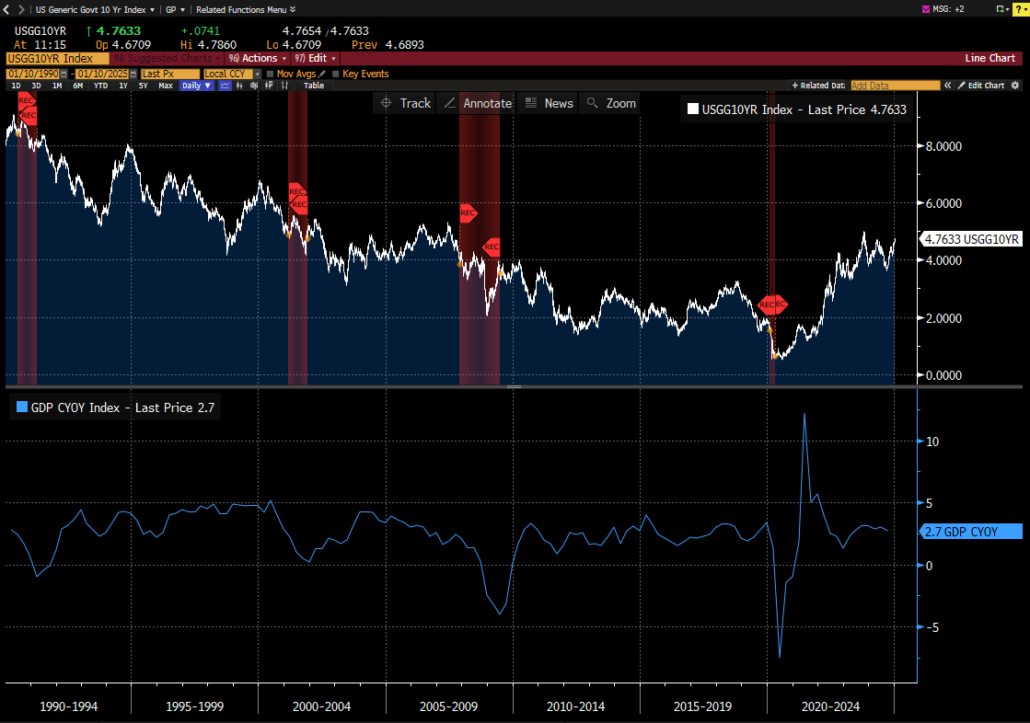

The level of the 10yr TSY and the GDP YoY should probably be weaker if the signal trend is to hold?

The question brings us to this chart.

Should we be concerned that a replay of 1981, hint Volcker, is around the corner ?

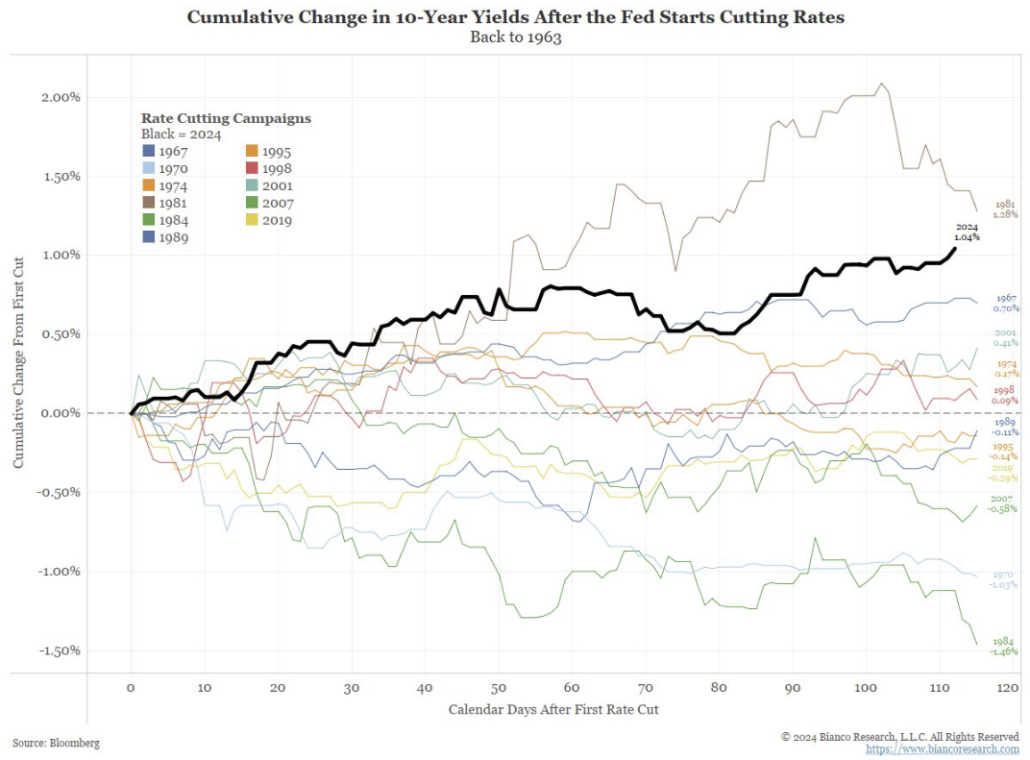

The 10-year yield is now up 104 basis points since the Fed started cutting (black).

In the last 60 years, only one time have 10-year yields risen more in a rate-cutting cycle, in 1981 (brown) when Volcker took the funds down from its world record high of 20%, and the bond market hated it (causing Yardeni to coin the term, “Bond Market Vigilantes”)

The current rate rise is “getting into the conversation” of surpassing the 1981 rate rise. It probably will not, but who thought it would get this close after 100+ days?

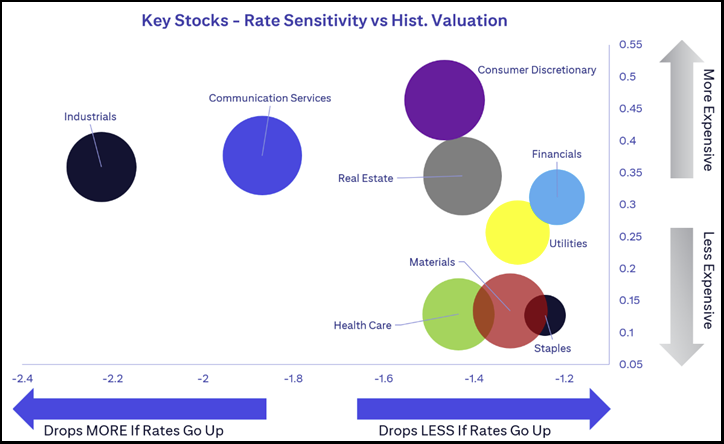

With the potential for higher rates, we thought this chart from Citi was worth pointing out.

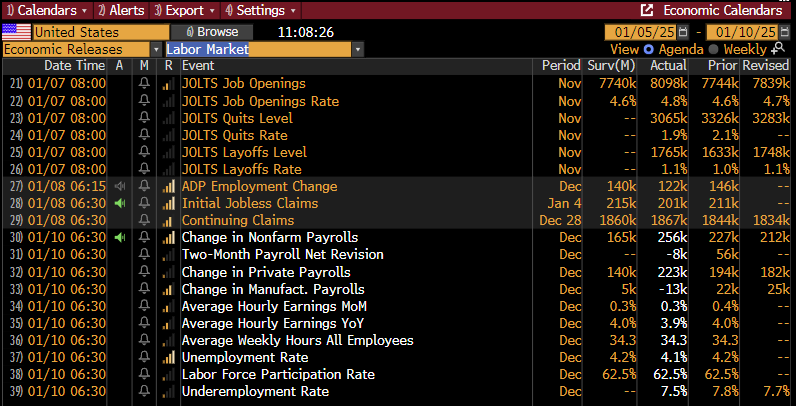

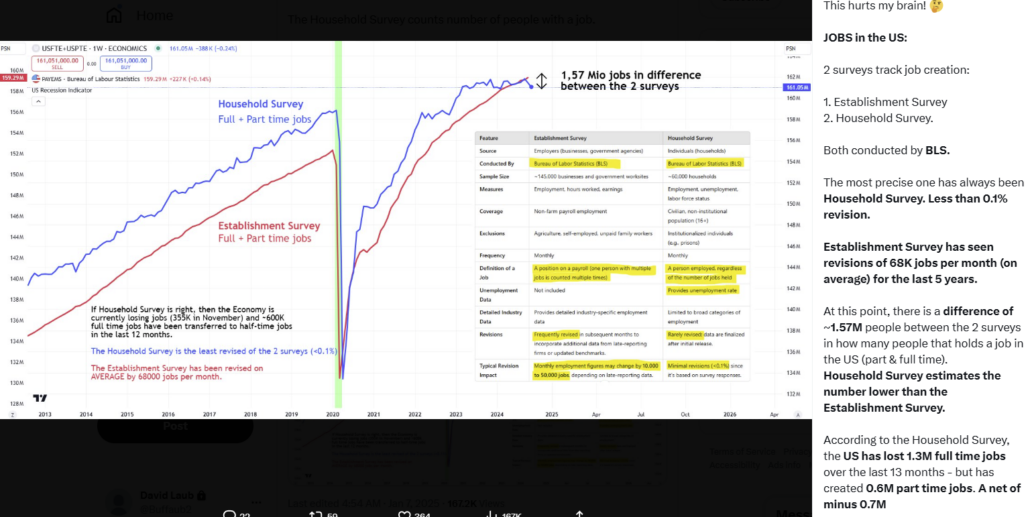

But there is one thing that nags some about the strength of the employment metrics. Is it possible that revisions could be forthcoming?

We saw this posted wondering if the comment on the bottom right of this screen shot, “ the US has lost 1.3M full time jobs over the last 13 months” will resonate with the people that make rate decisions.

Is it possible that the US consumer is beginning to sense something regarding employment?

Revolving Consumer Credit might be suggesting so, largest drawdown since Covid.

But, for perspective, it could simply be interest rate levels as well. Blue line below.

Please note that the Outstanding metric above, white line, does not include the 11/30/24 13.7% drop, but the rates are certainly the same if not higher.

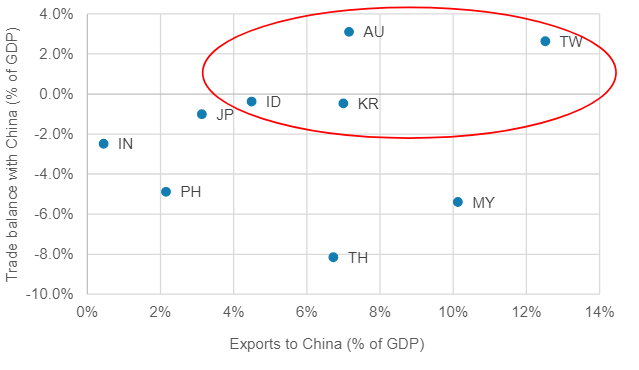

Tariffs:

Negative spillover from tariffs on China to pressure Korea, Taiwan, and Australia.

Best,

Meraki Trading Team

About Meraki Global Advisors

Meraki Global Advisors is a leading outsourced trading firm that eliminates investment managers’ implicit and explicit deadweight loss resulting from inefficient trading desk architectures. With locations in Park City, UT and Hong Kong, Meraki’s best-in-class traders provide conflict-free 24×6 global trading in every asset class, region, and country to hedge funds and asset managers of all sizes. Meraki Global Advisors LLC is a FINRA member and SEC Registered and Meraki Global Advisors (HK) Ltd is licensed and regulated by the Securities & Futures Commission of Hong Kong.

For more information, visit the Meraki Global Advisors website and LinkedIn page

Contact:

Mary McAvey

VP of Business Development