XRT/ Nat Gas/ New Home Sales/ Chart Updates

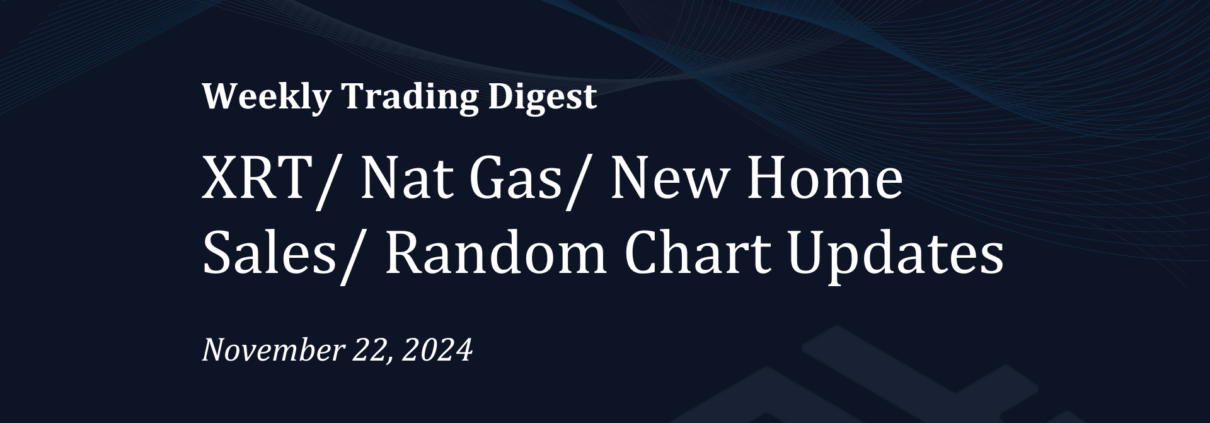

The XRT, S&P Retail ETF, is hitting a new 52-week high today, Friday November 22, so the Consumer must be a in great shape! We have addressed employment and the credit stress on the Consumer previously, but according to the action in the ETF, the outlook must be rosy.

So, we decided to look under the hood.

Top 25 Weightings:

Now, if we look at the best performers over the past 52 weeks, driving the performance, we see 3 of the top 5 names. A used car dealer, a supermarket, and a used clothing retailer.

We are by no means retail analysts, but thinking the health of the consumer is strong based on those 3 names might not be a safe assumption.

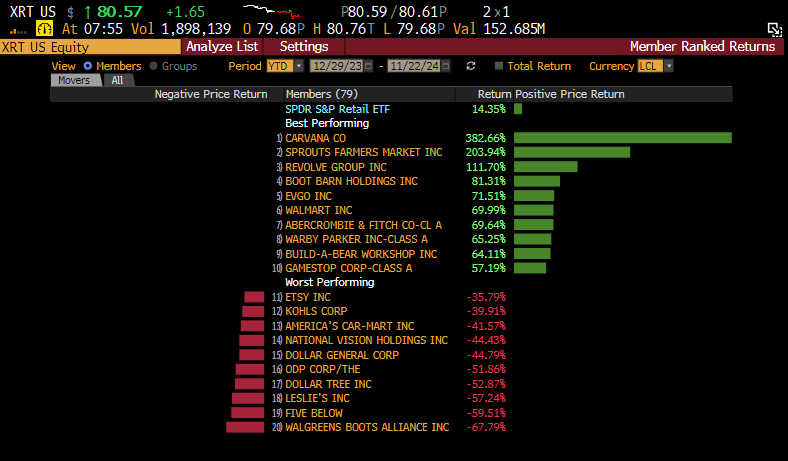

As a reminder, the University of Michigan Current Conditions survey was released today, this chart does not exactly jive with the XRT.

Why might the Current Conditions survey be hovering near rather depressing levels?

We came across a few charts that could help explain.

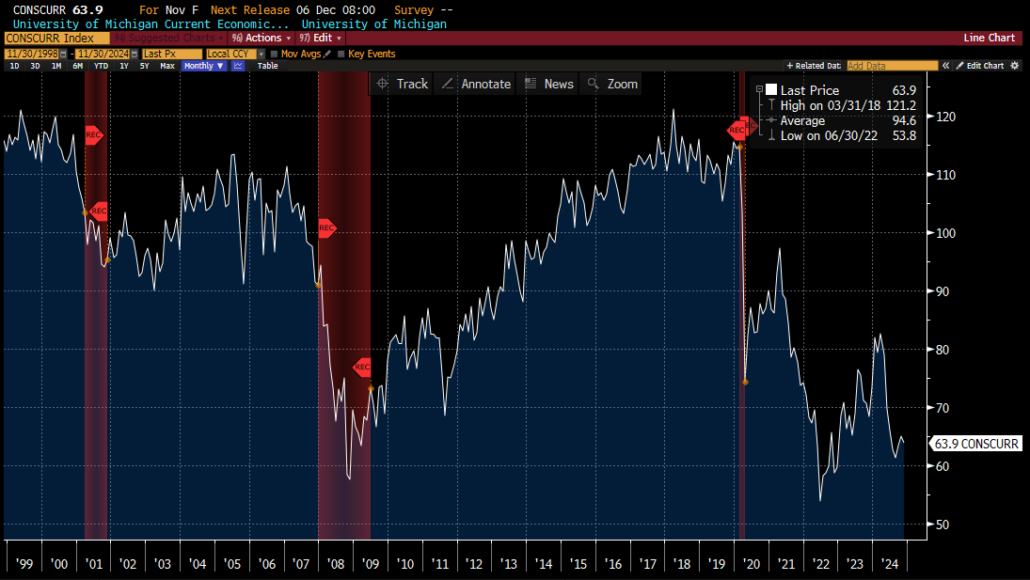

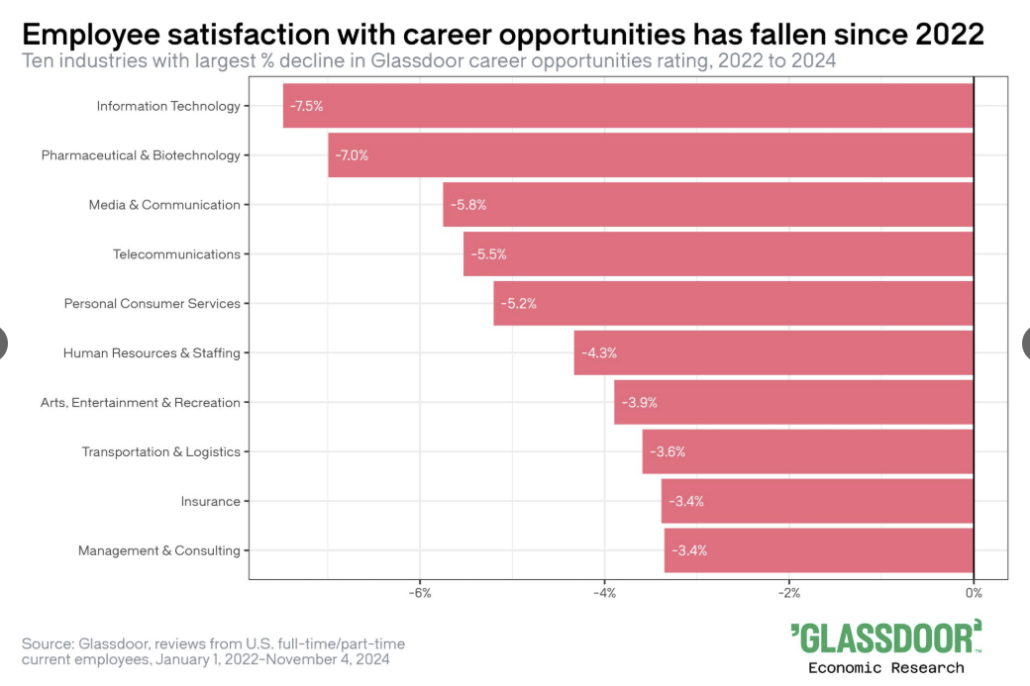

Professionals not feeling confident about their prospects according to below.

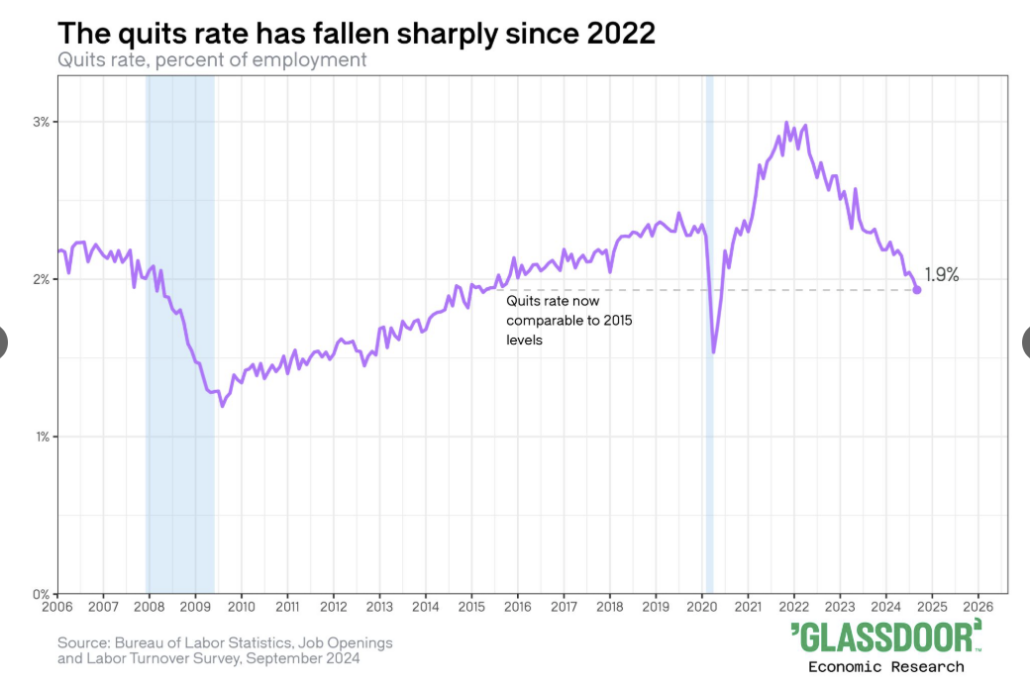

So, they are feeling stuck and unsatisfied, but they don’t seem to have other options or else the below chart would say otherwise.

Nat Gas

Could Nat Gas be headed for some rough sailing?

Technically approaching RSI, middle panel, and Stochastic levels, bottom panel, that historically suggest exhaustion.

Although the above may well be a subjective interpretation, the historical performance math is not. Nat gas is head for the worst 3-month performance period over the previous 10 years, beginning in December.

If we want to consider some familiar names in the space, with the exception of EQT at the bottom, all look to be exhausted as well. Just a thought.

New Home Sales

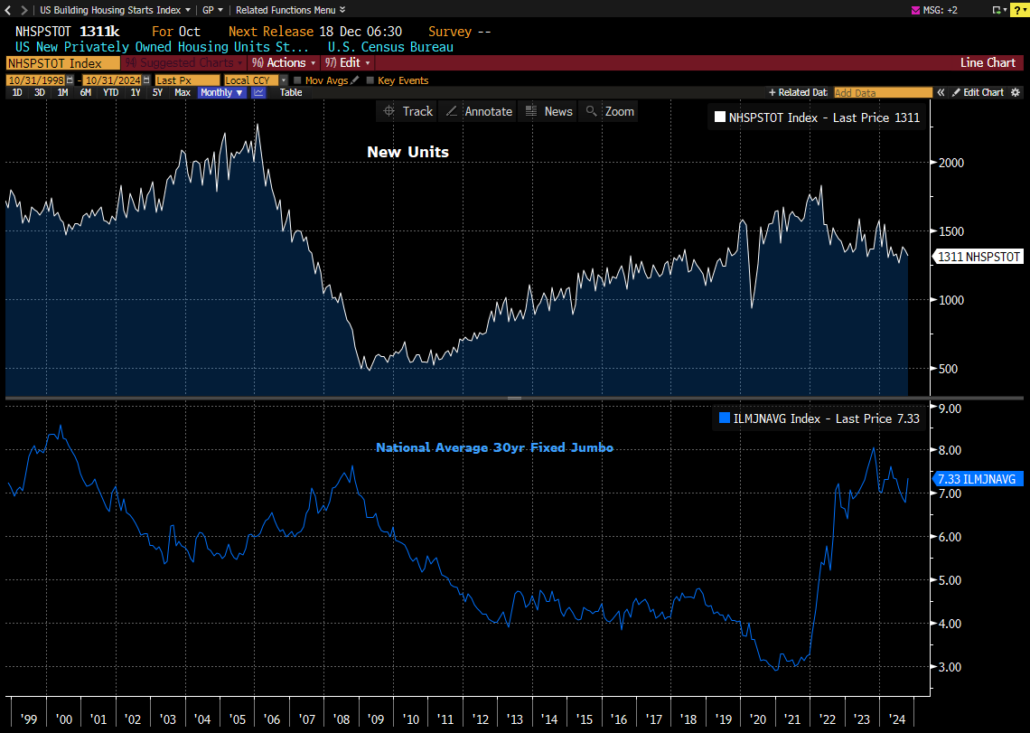

New Homes sales were released Tuesday November 19th. Considering the level of the national 30yr Fixed mortgage, and historical perspective, it’s surprising that the new unit levels are not lower.

If those Unit levels go lower, then estimates may follow, the EPS estimate for the underlying Index of XHB, Homebuilder ETF, is $806 which is now below initial estimates at the beginning of the year. And with the Index trading at close to 15X on a Fwd. P/E basis, an argument could be made that both estimates could head lower as well as the multiple compressing, unless we were to see a drastic change in mortgage rates.

Chart Updates

Didn’t see this one coming?

Insider Selling not exactly making investors feel warm and fuzzy.

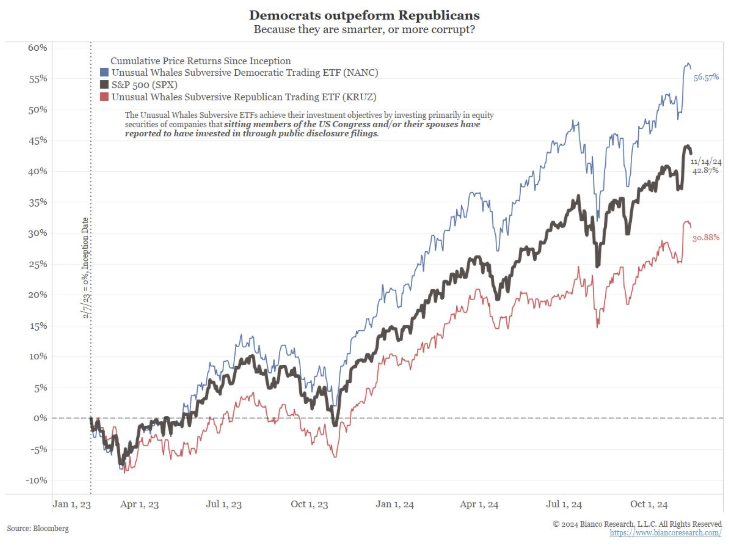

Follow the smart guys works after all.

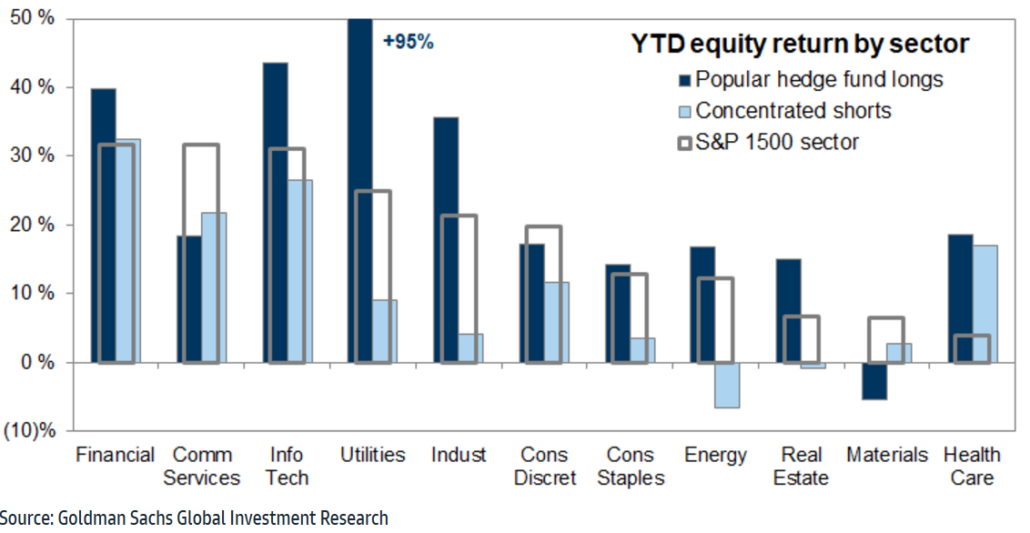

The most popular hedge fund long positions have outperformed in most sectors YTD as of November 15, 2024.

Have a great weekend!

Best,

Meraki Trading Team

About Meraki Global Advisors

Meraki Global Advisors is a leading outsourced trading firm that eliminates investment managers’ implicit and explicit deadweight loss resulting from inefficient trading desk architectures. With locations in Park City, UT and Hong Kong, Meraki’s best-in-class traders provide conflict-free 24×6 global trading in every asset class, region, and country to hedge funds and asset managers of all sizes. Meraki Global Advisors LLC is a FINRA member and SEC Registered and Meraki Global Advisors (HK) Ltd is licensed and regulated by the Securities & Futures Commission of Hong Kong.

For more information, visit the Meraki Global Advisors website and LinkedIn page

Contact:

Mary McAvey

VP of Business Development